Loss Protection Layers for System Investors

Losses in the System generally arise and can be absorbed at the association level before it impacts System bank capital. Credit rating agencies favorably refer to the System banks’ ‘second loss position’ and view it as a structural positive for investors. Strong association capital levels, strong bank capital levels, and a fully funded Insurance Fund provide layers of protection for investors and make the System more resilient. All the banks and associations currently exceed their minimum regulatory capital requirements as protection and support for the repayment of the outstanding insured debt.

However, only the banks, and not the associations, are jointly and severally liable for the repayment of Systemwide bonds, and the banks generally do not have direct access to the capital of their affiliated associations. Therefore, only the System Banks’ capital provides direct capital support for Systemwide bondholders. If a bank were unable to repay its portion of an insured Systemwide debt obligation, FCSIC would use the Insurance Fund to the extent available to make the payment on its behalf.

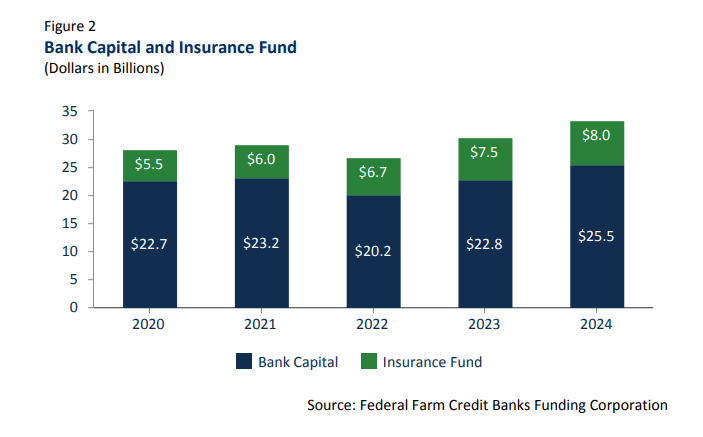

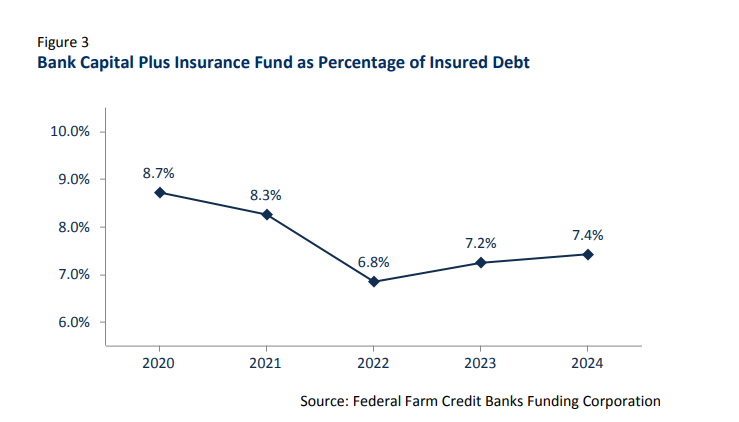

The sum of the amount of System bank capital plus the balance in the Insurance Fund increased 18.8%, from $28.2 billion at year-end 2020 to $33.5 billion at year-end 2024. The Insurance Fund is an asset of the United States government and does not constitute “capital” owned by the Farm Credit System. It is included in this discussion to illustrate the layers of protection for Systemwide bondholders. Bank capital plus the amount in the Insurance Fund as a percentage of insured debt outstanding was 7.4% as of year-end 2024.