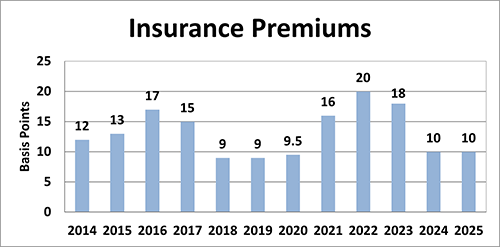

Insurance premiums

The current premium accrual rate is 10 basis points (0.10%) of adjusted insured debt (see letter to the System announcing the accrual rate for 2025).

FCSIC collects annual insurance premiums from each Farm Credit System bank as necessary to maintain the insurance fund at the level required by the Farm Credit Act. Each year, FCSIC’s goal is to collect the difference between what’s already in the fund and the amount needed to keep the fund at the statutory target level, known as the “secure base amount” (SBA).

FCSIC’s Board of Directors sets the insurance premium accrual rate at the beginning of each year for the coming year. Insurance premiums are “accrued” during the year and then paid by the banks to FCSIC at the beginning of the next calendar year. FCSIC’s Board reviews the premium assessment schedule at least semiannually and may use its discretion to adjust the premium assessments in response to changing conditions.

Please see FAQs for more information on FCSIC premiums.

Historical premium rates

The following chart shows average annual premium rates since 2014. By statute, premiums are assessed at the maximum of 20 basis points (0.20%) of adjusted insured debt unless the Board uses its discretion to set a lower premium rate. The Board will set a lower premium rate when it determines that a lower rate will be sufficient to maintain the Insurance Fund at the SBA.

Once the Insurance Fund attains the SBA, the law requires that premiums be reduced to the level necessary to maintain the Fund at the SBA.

One basis point is equal to 1/100th of 1% of insured debt obligations.

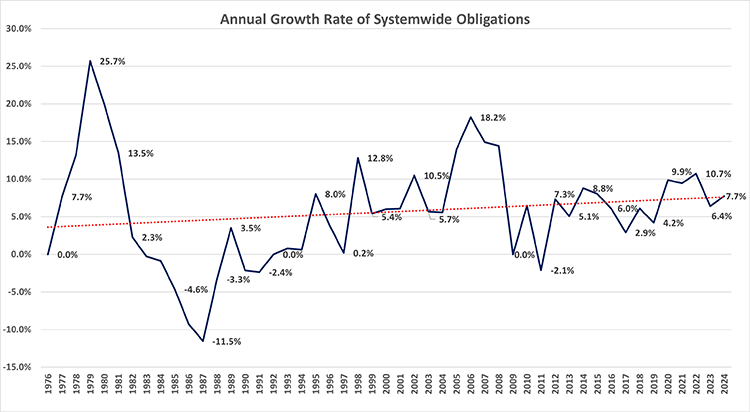

Historical growth of Insured Debt

In order to maintain the Insurance Fund at the statutory 2% Secure Base Amount, FCSIC must charge premiums sufficient to keep pace with the annual growth of insured System debt.

Impact of FCSIC Investments on Premium Rates

FCSIC’s investment earnings on the Insurance Fund directly reduce the amount of premiums it needs to collect from the Farm Credit System banks.