Frequently Asked Questions

Click on a category below for FAQs on the respective topic.

The Basics How FCSIC insurance works The Farm Credit System The Insurance Fund Premiums FCSIC operations Troubled System InstitutionsThe Farm Credit System

What is the Farm Credit System?

The Farm Credit System, created by Congress in 1916 to provide American agriculture with a dependable source of credit, is America’s oldest financial government sponsored enterprise (GSE). It is a network of federally chartered, cooperative lending institutions owned by the agricultural and rural customers it serves, including farmers, ranchers, producers and harvesters of aquatic products, agricultural cooperatives, and farm-related businesses. As of December 31, 2024, the System had 4 banks and 55 direct lender associations. Each association has its own chartered territory and is affiliated with one of the four banks.

What is a Government Sponsored Enterprise?

A government sponsored enterprise (GSE) is typically a federally chartered corporation created by Congress that is privately owned, designed to provide a source of credit nationwide, and limited to servicing one economic sector. Each GSE has a public or social purpose. GSEs are usually created because the private markets did not satisfy a purpose that Congress deems worthy — either to fill a credit gap or to enhance competitive behavior in the loan market. Congress gave each GSE certain features or benefits (called GSE attributes) to allow it to overcome the barriers that prevented purely private markets from developing.

Does the United States guarantee repayment of Farm Credit System debt?

No, the U.S. does not guarantee repayment of Farm Credit System (or other GSE) debts. While there is no guarantee of future government support, the FCS credit ratings are tied directly to the U.S. government credit ratings and the GSE status allows the FCS, and the other GSEs, to borrow money at very favorable rates (often a few basis points above U.S. Treasury obligations).

What is the Federal Farm Credit Banks Funding Corporation?

The Federal Farm Credit Funding Corporation is a Farm Credit System (FCS) institution that issues FCSIC-insured debt on behalf of the FCS banks. The Funding Corporation is not part of the U.S. government. It is a Farm Credit System institution chartered, regulated, and examined by the Farm Credit Administration.

How does the Farm Credit System structure protect investors?

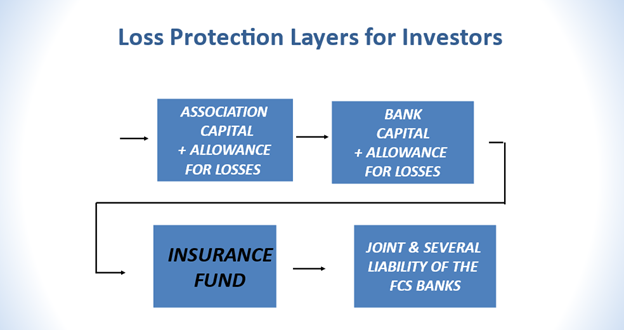

FCS banks are the obligors on the insured “Systemwide bonds”. However, losses in the Farm Credit System (FCS) generally arise and can be absorbed at the association level before it impacts FCS bank capital. Credit rating agencies favorably refer to the FCS banks’ “second loss position” and view it as a structural positive for investors. Strong association capital levels, strong bank capital levels, and a fully funded Insurance Fund provide layers of protection for investors and make the FCS more resilient.